State Marijuana Associations Rally To Urge Marijuana Banking Vote ‘Without Further Delay’

The American Trade Association for Cannabis and Hemp (ATACH)—along with trade groups representing marijuana businesses in 16 states plus Washington, D.C.—sent a letter about the need for the reform to Senate Banking Committee Chairman Sherrod Brown (D-OH) and Ranking Member Tim Scott (R-SC) on Friday.

But while the organizations are pressing the committee to urgently act on the Secure and Fair Enforcement (SAFE) Banking Act, the letter comes one day after a cannabis lobbyist reported that Brown told him there will be no vote in his panel next week, meaning it will not advance during the summer session. After the end of this month, senators won’t reconvene again until September.

In any case, ATACH and the state associations say that the status quo that leaves many marijuana businesses without access to banks and other traditional financial services is untenable, and the “public health and safety consequences are dire.”

“Many cannabis state licensed cannabis retailers are forced to do business in all cash and cannabis businesses are being targeted for violent robbery,” they wrote. “The latter examples have turned violent with dispensary robberies in places such as Washington, Oregon, Michigan, and Oklahoma.”

ATACH and the state organizations—representing businesses in Alabama, Alaska, Arizona, California, District of Columbia, Hawaii, Illinois, Maryland, Missouri, Mississippi, Montana, New York, Nevada, New Jersey, Ohio, Pennsylvania and Washington State—said that they “strongly support passage of the SAFE Banking Act without further delay.”

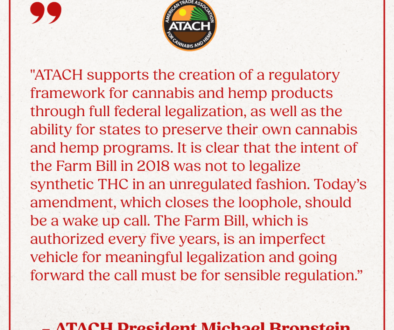

ATACH President Michael Bronstein said in a press release that “as Congress continues to debate the merits of the SAFE Banking Act, it fails to take into account that for every moment that goes by, state legal businesses and workers suffer the real world consequences of break-ins, armed robberies, and sometimes violent confrontations that have resulted in deaths.”

Senate Majority Leader Chuck Schumer (D-NY) had included the marijuana bill in his list of legislative priorities for the summer session—and Brown himself said in early June that he hoped to hold a markup of the bill “in the next two or three weeks”—but those plans did not materialize.

More recently, there have been signs that senators had reached a temporary impasse over the bill, with Brown insisting that the GOP sponsor, Sen. Steve Daines (R-MT), find more Republican members to formally cosponsor the measure. Daines, meanwhile, said Republicans were ready to act on the SAFE Banking Act as introduced.

The hold up, according to insiders, is disagreement over one section of the bill that concerns broader banking regulations. Certain Democrats like Sen. Jack Reed (D-RI) have pushed to remove or alter Section 10, but one senior GOP staffer told Marijuana Moment that doing so would be a “non-starter” for Republicans.

Daines has also previously cautioned against attempting to expand the measure with social justice reforms that progressives would like to add, though his office has told Marijuana Moment that the senator is “open” to adding expungements language, as proposed by Schumer.

In a Dear Colleague letter that was distributed this month, Schumer said that advancing SAFE Banking remains a legislative priority, but he also acknowledged that getting the job done “will not be easy” and require GOP buy-in.

A coalition of state marijuana associations is imploring Senate leaders to pass a bipartisan cannabis banking bill “without further delay.”

The American Trade Association for Cannabis and Hemp (ATACH)—along with trade groups representing marijuana businesses in 16 states plus Washington, D.C.—sent a letter about the need for the reform to Senate Banking Committee Chairman Sherrod Brown (D-OH) and Ranking Member Tim Scott (R-SC) on Friday.

But while the organizations are pressing the committee to urgently act on the Secure and Fair Enforcement (SAFE) Banking Act, the letter comes one day after a cannabis lobbyist reported that Brown told him there will be no vote in his panel next week, meaning it will not advance during the summer session. After the end of this month, senators won’t reconvene again until September.

In any case, ATACH and the state associations say that the status quo that leaves many marijuana businesses without access to banks and other traditional financial services is untenable, and the “public health and safety consequences are dire.”

“Many cannabis state licensed cannabis retailers are forced to do business in all cash and cannabis businesses are being targeted for violent robbery,” they wrote. “The latter examples have turned violent with dispensary robberies in places such as Washington, Oregon, Michigan, and Oklahoma.”

ATACH and the state organizations—representing businesses in Alabama, Alaska, Arizona, California, District of Columbia, Hawaii, Illinois, Maryland, Missouri, Mississippi, Montana, New York, Nevada, New Jersey, Ohio, Pennsylvania and Washington State—said that they “strongly support passage of the SAFE Banking Act without further delay.”

ATACH President Michael Bronstein said in a press release that “as Congress continues to debate the merits of the SAFE Banking Act, it fails to take into account that for every moment that goes by, state legal businesses and workers suffer the real world consequences of break-ins, armed robberies, and sometimes violent confrontations that have resulted in deaths.”

Senate Majority Leader Chuck Schumer (D-NY) had included the marijuana bill in his list of legislative priorities for the summer session—and Brown himself said in early June that he hoped to hold a markup of the bill “in the next two or three weeks”—but those plans did not materialize.

More recently, there have been signs that senators had reached a temporary impasse over the bill, with Brown insisting that the GOP sponsor, Sen. Steve Daines (R-MT), find more Republican members to formally cosponsor the measure. Daines, meanwhile, said Republicans were ready to act on the SAFE Banking Act as introduced.

The hold up, according to insiders, is disagreement over one section of the bill that concerns broader banking regulations. Certain Democrats like Sen. Jack Reed (D-RI) have pushed to remove or alter Section 10, but one senior GOP staffer told Marijuana Moment that doing so would be a “non-starter” for Republicans.

Daines has also previously cautioned against attempting to expand the measure with social justice reforms that progressives would like to add, though his office has told Marijuana Moment that the senator is “open” to adding expungements language, as proposed by Schumer.

In a Dear Colleague letter that was distributed this month, Schumer said that advancing SAFE Banking remains a legislative priority, but he also acknowledged that getting the job done “will not be easy” and require GOP buy-in.

Sen. John Cornyn (R-TX), meanwhile, said last week that the majority leader’s summer agenda is too ambitious, and he expressed serious doubts that marijuana banking—among a list of other legislative items that Schumer identified in the letter—will advance in the summer session.

Source:

State Marijuana Associations Rally To Urge Marijuana Banking Vote ‘Without Further Delay’