Why big players are bullish on the tiny cannabis beverage sector

A niche sector in the cannabis industry, beverages, is getting enormous attention from some of the world’s largest companies.

It’s a trend that is heating up this fall, with Molson Coors Beverage Co. and Canopy Growth Corp. expanding multistate distribution and predicting big gains across all levels of the THC spectrum, from nonintoxicating CBD sports drinks to THC-infused alcohol alternatives.

Karma Water, a functional-beverage company based in New York, partnered with Canopy Growth to launch a CBD water in roughly 25,000 retailers across the United States.

The move came only six months after Canopy launched its own line of flavored CBD beverages in the U.S., called Quatreau.

And Molson Coors this fall expanded distribution of its Truss line of CBD drinks, a joint venture with Canadian cannabis grower Hexo Corp., from only Colorado to 17 states.

Earlier this year, the American Trade Association for Cannabis and Hemp (ATACH) started a Cannabis Beverage Council that attracted the likes of Anheuser-Busch heir Adolphus Busch V.

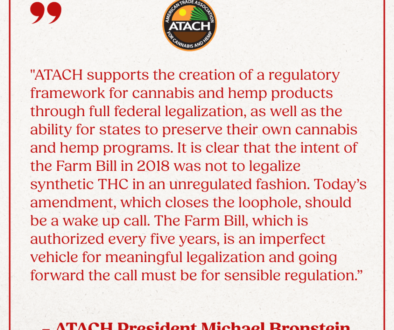

“There’s been massive interest among not just cannabis companies but also mainstream beverage companies,” ATACH president Michael Bronstein said.

Not there yet

It’s a lot of attention for a cannabis category that checks in below 2% of overall cannabis salesin adult-use marijuana retail among the five Western states tracked by Seattle-based analytics firm Headset.

Sales don’t look any better outside dispensaries.

Market analytics tracker NielsenIQ reported in March that sales of drinks containing hemp-derived CBD across major chains in grocery, drug and convenience stores had decreased 32%from the previous year.

The CBD-beverage slide was steeper than the decline of overall CBD products, where sales slipped 13% in the same period.

So why the enthusiasm from large consumer packaged goods companies? Analysts point to three main factors:

- Alcohol manufacturers are looking for new products because alcohol consumption (particularly beer intake) has fallen precipitously in recent decades.

- Manufacturing and emulsion advancements in recent years have made cannabis-infused beverages better-tasting than early cannabis beverages that sometimes were derided as “skunk water” for having chlorophyll flavors and a greasy aftertaste from undissolved fat-soluble cannabinoid molecules.

- Fewer places where adults can legally smoke or vape.

Booze moves

Analysts say the interest from large alcohol companies in the cannabis sector makes perfect sense.

That’s because falling beer consumption gives them reason to cast around for the next seltzer water or kombucha, drinks popular with younger consumers.

“It’s a hard time to be in the beer business,” said Harvard University’s Stephen Kaufman, a senior lecturer who evaluated Molson Coors’ cannabis strategy last month on a Harvard Business Review podcast.

Kaufman pointed out that:

- For baby boomers and Generation X, 50% of alcohol consumption is in beer.

- For millennials, only 25% of alcohol consumption is in beer, with the rest in wine and hard liquor.

- For Generation Z, just 12.5% of alcohol consumption is in beer.

“So their business is drying up,” Kaufman said.

In fact, Molson Coors in 2019 changed its name from the Molson Coors Brewing Co. to the Molson Coors Beverage Co.

And cannabis can seem a natural fit for companies used to selling into highly regulated markets.

“They’re looking outside of beer for growth, and marijuana is regulated and gets people intoxicated. So they’re like, ‘All right, this is a great space for us to play in. Because we’re used to regulation. We’re used to marketing in adult ways to other adults,’” said Bourcard Nesin, a New York-based analyst who covers the beverage industry for Rabobank, the Dutch banking giant.

Beyond intoxication

Molson Coors and Canopy both say they’re expanding with hemp-derived CBD because THC drinks remain federally illegal in the U.S.

But CBD and other nonintoxicating cannabinoids are more than placeholders for the drinks sector, said Carmen Brace, founder of Aclara Research, a Chicago company that analyzes CBD consumer data.

“Functional beverages are some of the most promising products in food,” she said.

“Everyone is interested in innovation road maps to capture more share of stomach by daypart and occasion. And consumers are looking for foods that satisfy more than taste.”

Aclara partnered with Ipsos this year to survey roughly 1,100 cannabis and CBD users living in states with legal adult-use marijuana and found that while beverages are the least common form for cannabis consumption, the sector is growing.

“Maybe beverages are not used as frequently as the usual suspects – flower, vape, edible – but beverages are more frequently used in social occasions,” Brace said.

“As more consumers look for foods with a purpose, the functional beverage becomes more important.”

Beverage outlook

However, the excitement about cannabinoid drinks from large food and beverage companies such as Molson Coors and Canopy doesn’t change the fact these companies face the same headwinds as all other large cannabis manufacturers.

These products are going to remain stuck in research and development until more nations join Canada and regulate drinks for national and international distribution.

Data about cannabinoid drink sales are notoriously spotty outside Canada, Nesin pointed out, and the largest CPG players are staying away.

“The prospects for growth in the marijuana and hemp industry are predicated on federal regulations and legalization that allows responsible companies and healthy competition to exist, where cutting corners is not something that gives you a strategic advantage,” he said.

“And I think that’s really going to make a difference in terms of the beverage industry, which takes quite a bit of infrastructure to scale and to be well formulated and consistent.”

https://mjbizdaily.com/why-big-players-are-bullish-on-the-tiny-cannabis-beverage-sector/?utm_medium=email&utm_source=newsletter&utm_campaign=MJD_20211108_NEWS_Daily