The Cannabis Industry Strives for Proper Finance

Cannabis is quickly becoming a multi-billion dollar industry with sales expected to reach almost $30 billion by 2025 in the U.S. However, the cannabis industry struggles to reach that state as it lacks the proper financial security businesses in other industries have.

The banking system is currently regulated by and must follow federal law. Under these circumstances, cannabis is still considered a Schedule I drug. Therefore, if a bank decides to—let’s say—lend a loan to a cannabis business, they risk charges of aiding and abetting a federal crime.

The lack of coordination between federal and state regulations has promoted giant problems for cannabis entrepreneurs. Here are just a few examples:

- Cannabis businesses have a more difficult time receiving banking services. This means they must operate with cash and handle basic operating necessities (i.e. payroll, checking, credit accounts) entirely on their own.

- While some banks (usually small credit unions) will service cannabis businesses, this usually comes with extra efforts on the bank’s end. To supplement the extra work, banks will charge cannabis businesses more money for their services than they would other businesses.

- Cannabis businesses are not allowed to pay taxes electronically or by check. Instead, they must deposit large amounts of cash to state tax offices.

These problems have only been exacerbated by the COVID-19 outbreak. While cannabis businesses were deemed essential in most states where it’s legalized, the overall economic hit had an effect on every business. Not to mention, back in late May and June, some businesses were subject to looting.

Efforts have been made to combat the pandemic. Back in early May, when Congress was working on a stimulus bill for small businesses, 24 state-level cannabis trade associations and four financial institutions sent a letter to Congress urging for economic relief for the cannabis industry.

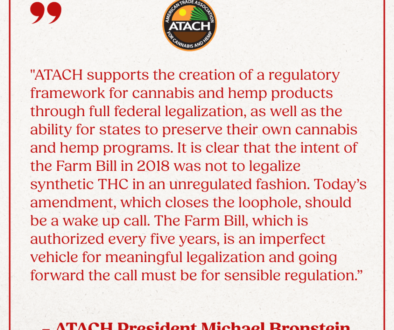

The American Trade Association of Cannabis and Hemp (ATACH) revealed to DOPE that the organization’s efforts did go noticed and have facilitated an entire conversation about the industry and extending protections to cannabis businesses. These discussions have, in turn, laid down the grassroots for enabling political involvement. In their own words:

As “a recent example, during the DNC and RNC, ATACH facilitated a conversation about marijuana policy with each party,” an ATACH representative told DOPE. “Top-line discussions in these forums revolved around social justice and equity (how do we build an inclusive industry as more states legalize and national pressure swells to end federal prohibition), and criminal reform. On the RNC side, conversations centered on taxation policy (including 280E), revenue models, and where the nation’s pulse is at as it relates to ending federal prohibition.”

“[As] a recent example, during the DNC and RNC, ATACH facilitated a conversation about marijuana policy with each party. “Top-line discussions in these forums revolved around social justice and equity (how do we build an inclusive industry as more states legalize and national pressure swells to end federal prohibition), and criminal reform.”

Organizations like ATACH are making sure progress is being made. Unfortunately, until anything is finalized, the cannabis industry must continue to strive for proper finance.